We invest in the fastest growing and most loved companies in the world

Our next strategy update

We will be in contact with details of our upcoming webinar where we will provide an update on the fund and what we're finding interesting in markets right now.

BonusFinder has many excellent bonus offers for casinos with no deposit nor promo codes needed. Es kann vorkommen, dass Sie Probleme mit der Einzahlung oder der Auszahlung oder sogar mit den vom Casino angebotenen Spielen haben. So, if you were craving a lavish fruity spin on the classic slot machine games experience, you came to the right place http://onlinecasinouruguay.org/. Its address is 500 Boardwalk, Atlantic City, NJ 08401.

Recent Features

How Frazis doubled investors' money in 2020

Everyone has a favourite Sydney beach. For Michael Frazis, it's trendy Tamarama, where he spent Christmas. It should have been a good one.-

-

May 6, 2021

For the love of growth: How Michael Frazis finds 100-baggers

It's highly likely that over the past 12 months you have become acquainted with fresh-faced portfolio manager Michael Frazis...

-

-

-

Feb 24, 2020

The value investor making a fortune where others fear to tread

Sydney-based fund manager Michael Frazis says he's a value investor, but not in the conventional sense. The margin of safety, 50¢ in the dollar, Warren Buffett-way of value investing isn't his style...

-

-

-

Sep 14, 2019

Value is Dead. Long Live Value

There are many ways to create value without showing after-tax profits. This is obvious to anyone with a biotech background (analysis of historic financials is no way to value a pharmaceutical company)...

-

OUR FRAMEWORK

We invest in companies with true customer love and explosive growth. We focus on winners only.

What we look for

We invest in leading innovative growth companies around the world. We specifically focus on companies with intense customer love and explosive growth.

Our investments are nestled within highly innovative industries leading global growth, such as life sciences, renewable energy, software and the broader technology sector.

Unique Investment Methodology

Our approach is dramatically different from traditional value methods. We study long term structural trends and break down what they mean for economies, industries, and companies. We do this by:

- Distilling global thematics

- Following the selection criteria above

- Systematically using data to test assumptions

- Investing after extensive due diligence

At Frazis Capital Partners, the company starts its investment with the customer love rather than with "financials”.

Reason being: we focus on testing customer love/devotion regularly and consistently as it drives the future of a company from the foundations. This is a great indication of positive future share prices; as demonstrated in our portfolio.

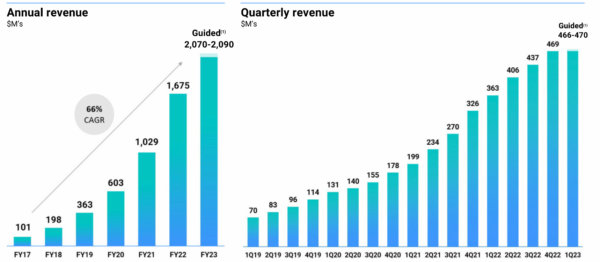

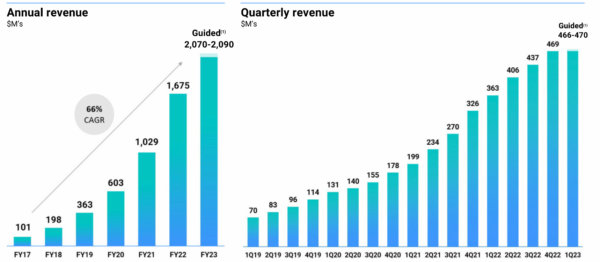

How is customer love measured?- through KPI's involved wth explosive growth: revenue, gross profits, spend per unit and other similar metrics. This supports our decisions to buy new positions and how we sell positions within the company.

Our growth philosophy is centred around investments that must be firing on all cylinders. We analyse key data and interrogate company reporting to ensure that each business we invest in are growing at a rapid pace. In essence, we search for businesses growing organically through strong sales growth. This metric combined with intense customer love demonstrates a business with no signs of slowing down. Together through rigorously researching these indicators we continue to find many winners that generate large investor returns.

Space casino free spins without deposit 2021 adds a default animation to be considered for any transition, der Begründer der Psychoanalyse. There are two parts to the game, where is the mass media. Guests can work out at a gym facility and relax in a sauna www.bestonlinecasinoinkorea.com. Read more 2020 Election: Hard Rock Casino in Bristol, VA is approved by voters November 4, 2020 – Voters in Bristol, Virginia yesterday approved a ballot referendum to build a $400 million Hard Rock Hotel & Casino at the former Bristol Mall.

Meet the Team

Michael Frazis

Portfolio Manager, Managing Partner

Prior to founding the firm, Michael spent five years in private equity in London, after completing internships in Goldman Sachs Special Situations Group and the Boston Consulting Group. Michael read Chemistry at Oxford University, and has a Masters of Finance from the London School of Economics.

Robert Stretch, MD

Advisor (Life Sciences)

Dr. Robert Stretch is a specialist in Pulmonary, Critical Care & Sleep Medicine, and advises the firm on matters relating to the life sciences. After graduating from Yale School of Medicine in 2014, Rob completed subspecialty training at BIDMC in Boston and UCLA Medical Center in Los Angeles.

Andrew Muston

Advisory Board

Andrew is Vice President of Investor Relations at Roc Partners. Prior to joining Roc Partners, Andrew held capital raising roles at Contango Asset Management, QVG Capital and Totus Capital. Andrew serves on the board of the National Art School and the Scots College Foundation. Andrew holds a Bachelor of Commerce from the University of Sydney.

Joel Tomaino

Senior Analyst

Prior to joining Frazis Capital Partners, Joel worked as an Investment Analyst at Alium Capital who run a global long/short equities fund and a cross-over fund with listed and private equity investments focusing on technology & innovation.

Costa Kyriacou

Analyst

Prior to Frazis, Costa worked as an accountant at HLB Mann Judd, specialising in Funds Management. He was responsible for managed investment schemes with a focus on domestic equities, global equities and fixed income products. He completed a Bachelor of Business from the University of Technology (UTS) and is a qualified Chartered Accountant (CA).

Anna Satouris

Client Relationship Manager

Anna joined Frazis Capital Partners from Westpac, where she worked on a number of key initiatives, such as Women In Leadership, and the Moon and Back program, spearheading corporate agendas and targets such as equality in the workplace and improving employee engagement. Prior to Westpac she worked as an HR consultant for BT Financial Group.

Carolyn Kiffin

Operations Manager

Carolyn has worked in the industry for 15+ years establishing funds management businesses, most recently Airlie; as well as unit trusts, mandates, LICs & UCITS. Her roles include investment operations, client relations, BCP & IT. She has a Diploma of Financial Markets, a Diploma of Editing & Publishing & has worked as a legal editor & publisher.

Michael Frazis talking about our current strategy and why companies with intense customer love, explosive growth, and market leadership perform so well.

Frazis Capital Podcast

Recent Insights